Cash flow management is the lifeblood of any business, ensuring that a company has enough liquidity to meet its obligations, invest in growth opportunities, and navigate economic challenges. Effective cash flow management involves monitoring, analyzing, and optimizing the inflow and outflow of cash within an organisation.

TallyPrime, a powerful business management software, offers comprehensive tools to help businesses manage their cash flow efficiently. In this blog, we’ll see the importance of cash flow management and how TallyPrime can be utilised to master this critical aspect of financial management.

Importance of Cash Flow Management

Effective cash flow management is essential for any business. Here’s why:

Liquidity Maintenance: Ensures the business has sufficient cash to meet short-term liabilities and unexpected expenses.

Investment Opportunities: Provides the flexibility to seize growth opportunities by ensuring available cash for investment.

Debt Management: Helps in timely repayment of debts, thus avoiding penalties and maintaining a good credit score.

Operational Continuity: Ensures smooth daily operations without financial disruptions.

Financial Stability: Contributes to the overall financial health and sustainability of the business.

How TallyPrime Helps in Cash Flow Management

TallyPrime provides a range of features and reports that facilitate effective cash flow management. These include the Cash Flow Statement, Fund Flow Statement, and various tools for monitoring and analysing cash transactions.

Cash Flow Statement

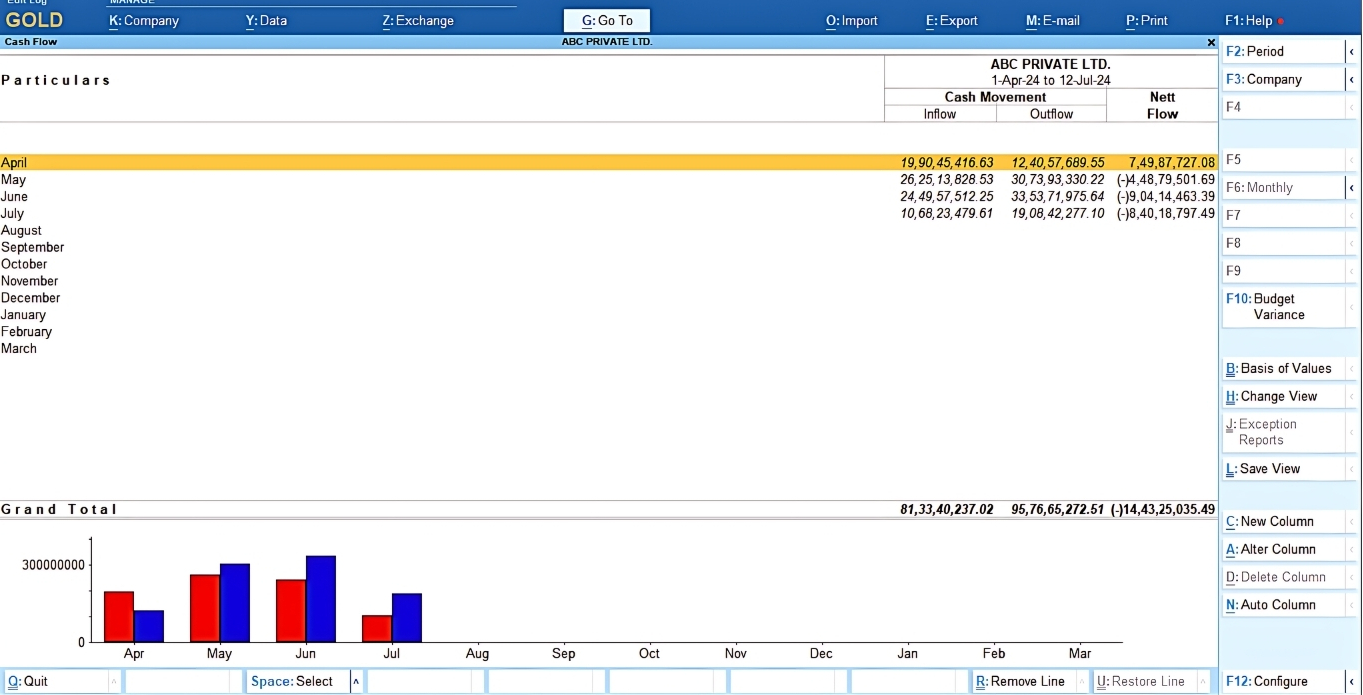

The Cash Flow Statement in TallyPrime provides a detailed view of cash inflows and outflows over a specific period. This report helps businesses understand where their cash is coming from and how it is being spent, enabling them to make informed decisions.

- How to Generate a Cash Flow Statement in TallyPrime:

Navigate to Gateway of Tally: Open TallyPrime and go to the Gateway of Tally.

-

Select Cash Flow: From the menu, select > Display More Reports > Cash Flow.

-

Choose the Period: Select the period for which you want to generate the report.

-

View the Report: The Cash Flow Statement will display, showing the cash inflows and outflows categorized by operating, investing, and financing activities.

This statement helps identify cash shortages or surpluses and provides insights into the company’s liquidity position.

Fund Flow Statement

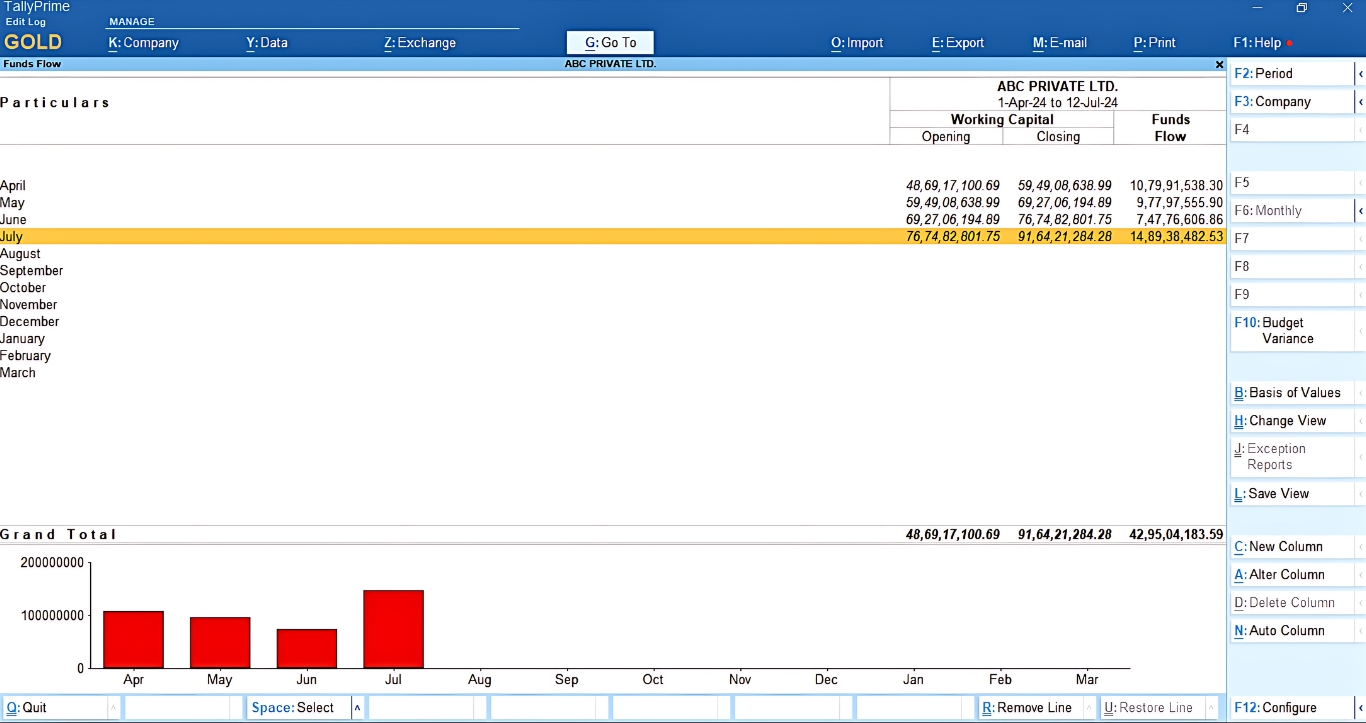

The Fund Flow Statement complements the Cash Flow Statement by providing insights into the movement of funds within the business. It shows the sources and uses of funds, highlighting changes in the company’s financial position between two balance sheet dates.

- How to Generate a Fund Flow Statement in TallyPrime:

Navigate to Gateway of Tally: Open TallyPrime and go to the Gateway of Tally.

Select Cash Flow: From the menu, select Display More Reports > Fund Flow.

Choose the Period: Select the period for which you want to generate the report.

-

View the Report: The Fund Flow Statement will display, showing the sources and applications of funds.

This statement helps in understanding the financial stability and operational efficiency of the business.

Monitoring Cash Transactions

TallyPrime provides various tools to monitor cash transactions, ensuring accurate tracking and management of cash flow.

Voucher Entry: TallyPrime allows for easy entry of cash transactions through vouchers. Users can record receipts, payments, contra entries (for bank and cash transfers), and journal entries. Accurate recording of these transactions is crucial for maintaining a clear view of cash flow.

Bank Reconciliation: Bank reconciliation in TallyPrime helps ensure that the cash book balances match the bank statement balances. This process is vital for detecting discrepancies, errors, or fraudulent activities. TallyPrime’s bank reconciliation feature simplifies this process by allowing users to match transactions easily and reconcile accounts efficiently.

Budgeting and Forecasting: Budgeting is an essential aspect of cash flow management. TallyPrime enables businesses to set budgets for various accounts and compare actual performance against these budgets. This feature helps businesses plan their cash flow more effectively and take corrective actions when necessary.

Ageing Analysis: Ageing analysis reports in TallyPrime help businesses manage their receivables and payables more effectively. These reports show the age of outstanding invoices, helping businesses follow up on overdue payments and manage their cash flow better.

Ratio Analysis: Ratio analysis in TallyPrime provides insights into the financial health of the business. Key ratios like the current ratio, quick ratio, and cash ratio help businesses understand their liquidity position and manage cash flow more effectively.

How Antraweb Adds Value in Cash Flow Management.

Antraweb Technologies offers specialized services that improve cash flow management. Our Tally Customisation & Implementation service ensures that Tally is tailored to meet the specific requirements of your business, including custom reports and modules. Additionally, we assist in integrating Tally with other business software, facilitating a seamless flow of financial data that enhances cash flow monitoring and analysis.

- Best Practices for Cash Flow Management

Regular Monitoring: Keep a close eye on cash flow reports and statements regularly.

Timely Invoicing: Ensure invoices are sent out promptly and follow up on overdue payments.

Expense Management: Control unnecessary expenses and optimise spending.

Maintain Reserves: Keep a cash reserve for unexpected expenses or downturns.

Leverage Technology: Use tools like TallyPrime to automate and streamline cash flow management processes.

Effective cash flow management is essential for the success and sustainability of any business. Tally offers a comprehensive suite of tools and reports that enable businesses to monitor, analyse, and optimise their cash flow efficiently. By leveraging TallyPrime’s features, businesses can maintain liquidity, seize growth opportunities, manage debts, and ensure operational continuity.

Adopting best practices in cash flow management with the help of TallyPrime can significantly contribute to a business's financial health and long-term success.

To know about Tally's capabilities more, including customization and solution boosters, for improving cash flow management, consider reaching out to Antraweb Technologies

Want to get more details about Tally Services visit here → Antraweb Tally Services

Our dedicated support team is ready to guide and support you, ensuring your business achieves maximum growth.