- April 01, 2024

How you can use Tally for Material Requirement Planning

Are you tired of handling inventory shortages, production delays and procurement inefficiencies. Here’s Tally’s Material Requirement Planning (MRP), an add-on module that can revolutionize the way you manage your inventory and production.

- March 30, 2024

Tally-VTiger Integration Revolutionizes accounting and CRM

Vtiger is an open source CRM used by businesses worldwide. It is used to maintain and improve customer relationships by creating various automated funnels for customer communication and deriving analytics for the same.

- March 23, 2024

CA Audit Tips and Tricks For Tally Users

Tally users who knows how Tally is used at an advanced level is often considered a very useful resource for a business. This is because of the value they add to their job through their tally skills

- February 29, 2024

API Integrations With TallyPrime

Mobile phones connect people across cities, countries, and continents. Similarly, APIs connect different software, irrespective of their frameworks. But what is the need to connect different software?

- February 15, 2024

Clause 43B(H) - Make Sure to Make Payments within 45 Days to MSMEs.

Micro, small and medium enterprises (MSMEs) plays a crucial role in economic development and growth in country like India. They contribute significantly to employment generation, industrial production, and overall economic growth.

- January 31, 2024

Tips To Get Tally Support at the Earliest

Tally supports critical functions of a business like accounting, taxation, operations, etc. A failure in such a system can cause disruption in these vital processes. At such a time, you may want to have immediate tally software support.

- January 30, 2024

Tally Prime New Pricing in 2024

Change is the real constant in the ever-changing era of business software. In a move towards continual innovation and enhanced user experience, Tally Solutions, a pioneer in accounting and business management software

- December 31, 2023

Tally to WhatsApp - An Integration We All Have Been Waiting for!

Enhance business productivity through the seamless integration of TallyPrime 4.0 with WhatsApp. Simplify communication, start trials, and effortlessly renew subscriptions for a smooth operational experience.

- December 30, 2023

What’s New in Tally 4.0?

Tally is said to be one of those software which is continuously growing. Looking for integration, opportunities and taking them to make the lives of the businessmen even more convenient. So that they can reach out to their vendors and customers easily.

- November 30, 2023

Seamless Tally Integration with your Software

As the technological landscapes are rapidly evolving businesses are constantly on the lookout for solutions that streamline their operations and enhance overall efficiency. That's where the Tally Integration comes

- November 28, 2023

The Evolution from Tally ERP 9 to Tally Prime

In the world of business, managing finances is like navigating a ship through ever-changing waters. Imagine a reliable compass, Tally software, guiding countless businesses through these financial crises.

- October 31, 2023

How to Boost Your Tally Performance in 2023

34 Years ago, a revolution was set with the introduction of the first ever accounting software, Tally!! Ever since its inception till today, Tally is the most commonly used business and accounting software.

- October 31, 2023

How Tally Customization Has Benefited The South Asian Countries, The Middle East And Africa

Every business strives to have a competitive advantage. Customization of your business assisting software can provide you with that edge over your competitors. Tally customization is one very common way of

- September 31, 2023

Tally Prime's Security Features: Safeguarding Your Business Data

Tally Prime is known for its ability to keep data confidential and safe. The biggest reason for its extensive use and preference is its ability to keep data safe and free from any type of malicious attack.

- September 25, 2023

Tally On Cloud: The Future of Seamless Accounting in the Digital Age

Cloud computing is a technology that's revolutionizing business operations. Tally on the Cloud is an ideal example of a tool driving this change, providing numerous benefits to businesses of all sizes.

- August 31, 2023

Protect Your Tally Data From Ransomware Attacks

Tally Data is sensitive and hackers are always looking to find vulnerabilities and new ways of hacking data. The growth of technology and the internet has led to the growth of hackers and their malicious intent equally. Ransomware virus is something most businesses are well aware...

- August 30, 2023

Upgrade Your Communication With Your Customers Using Tally

Any successful firm must have effective customer communication. It acts as the cornerstone for creating lasting connections, raising consumer satisfaction, and fostering corporate expansion. Businesses may explain their value offer, respond to...

- July 31, 2023

Export Documentation in Tally

As an exporter in India, you need to have certain documents as declared by the Directorate General of Foreign Trade (DGFT) and the customs authorities. Over the years, India has streamlined its exporting process to ensure it is business-friendly...

- July 30, 2023

How Tally Barcode And Label Printing Help Your Business

Tally has been the flag bearer in the accounting software market. From 1989 to the present time, Tally has continuously evolved and improved its ability to serve businesses...

- June 30, 2023

Overcoming Business Challenges with the Power of TallyPrime

Automation has become an indispensable factor in the growth and success of today's businesses. It is inseparable from the concept of growth, as both mutually benefit and reinforce each other. In the realm of finance, automation has played a pivotal role in driving...

- June 30, 2023

The Role Of Tally In Digital Transformation

The software has been improved over the years to complete business management software. Different processes have been digitized to improve the output. This has led to not only improved results but also proven to be time-saving, shown better efficiency, reduced...

- June 20, 2023

What's New In TallyPrime 3.0

Tally just released its latest version in beta so that you can test it for yourself! In case you’re wondering what the latest version (TallyPrime 3.0) is all about, here is a detailed walk through of the various new features, feature upgrades and improvements for...

- May 30, 2023

How To Prepare For E-Invoicing If Your Turnover Is Over 5 Crore

E-Invoicing might sound like a buzzword that's been floating around for a while. But if you're running a business with a turnover surpassing 10 crore, you've likely seen its benefits. E-Invoicing isn't as daunting as it sounds, and in reality..

- May 30, 2023

How To Use Tally For Advanced Reporting

Reporting in Tally Prime is by far the best feature of Tally as it allows you to review the complete health of the business. From profit and loss to inventory movement analysis reports Tally ensures you have the detailed reports to make sound and accurate decisions.

- April 30, 2023

Understanding Security Features of Tally on Cloud

Cyber threats are on the rise. According to a research by Kaspersky, on an average people affected by fraud spend over 776$ and over 20 hours trying to fix all the mess created by the.

- March 31, 2023

Multi-Task With Tally Gold

Businesses belonging to different industries use Tally, an accounting software created by Tally Solutions Pvt Ltd, to manage their finances, inventories, accounts, and other operations.

- March 31, 2023

TallyPrime 3.0 - Is This Update For You?

Tally is being used by over 2 million users worldwide. The current latest version of Tally is tally prime 2.1 and very soon a new version will be released by the name TallyPrime 3.0.

- February 25, 2023

How Tally on Cloud helps Businesses with Multiple Branches

Managing multiple locations of a business is not an easy task. Considering all the collaboration, communication and coordination that goes into creating a successful multiple-branch business...

- February 24, 2023

5 common business mistake to avoid using Tally

Tally is known for its ability to enhance business performance through automation. Business performance can be further enhanced by minimising business mistakes that lead to wastage of resources. Here are the top ...

- January 28, 2023

What to Expect from TallyPrime's Latest Release 3.0?

Tally is software that fits all types of businesses. While Tally is used most commonly for accounting, return filing and data analysis, there are many other reasons Tally is used considering all the features of Tally...

- January 25, 2023

How to Make the Most of Your TallyPrime Software?

Every business wants to cut down on costs. Yet, most businesses are wasting the true potential of good software like - Tally. Tally brings in thousands of amazing business management offers. Most businesses use...

- December 25, 2022

9 Critical Questions that Tally Prime reports answer

TallyPrime has some really awesome reports that can be edited to suit your business reporting needs. Tally Prime software is said to have about 300+ insightful reports. These reports provide a complete 360 degree view of business’ financial health. The software also allows you to..

- December 20, 2022

How does Antraweb strive to add value to their clients?

Antraweb Technologies is a leading name in the Tally and Tally services industry. Even though Tally has thousands of service providers spread throughout the globe, Antraweb has remained to be the best service provider throughout its journey of 30+ years.

- November 25, 2022

4 Reasons businesses must Customise their Invoices

Invoices and the creativity used to design them have grown by leaps and bounds. Invoices are a very important set of documents that can directly affect how well or badly your business performs. This is mainly because an invoice is the last customer touch point for most businesses. Most businesses, while creating a custom invoice, focus on the creative...

- November 20, 2022

Top 9 Tally Tips & Tricks - 2022

You can have the best software and still be inefficient. The primary purpose of a software is to make your work easy while improving your efficiency. Similarly, Tally too is used to increase the efficiency of a business. Knowing the best Tally tips and tricks is a good way of ensuring you are not just using the software efficiently but making sure you complete your work quickly and more smartly.

- October 20, 2022

How to Fix Tally on ‘Educational mode’?

‘Tally on Educational Mode’ - This is a common problem faced by many Tally licensed users. What exactly is Tally Educational mode and how exactly can Tally users fix it? Tally education mode can be caused by simple reasons that may be solved by uninstalling and reinstalling Tally. When do we say Tally is in Educational mode? In Tally educational mode, on the top left you will be able to see ‘Tally EDU’...

- October 10, 2022

Why you should start using e-invoicing for your business

As per the latest notification by the GST Council, all B2B businesses with 10crore+ turnover must implement E-invoicing in their day to day business process. Similarly, businesses with 5cr+ turnover will have to inculcate e-invoicing starting from 1st January 2023. Government is slowly making E-invoicing necessary for more ...

- September 30, 2022

Are you using your Tally on a Shared Cloud?

Cloud services are of many types like shared, private and hybrid. You decide the type of service based on your data and business requirements. A shared cloud is one of the cheapest types of cloud service. Many Tally users use Tally on a shared Cloud. If you are one of those users, there are some risks associated with the shared cloud that you must be aware of...

- September 20, 2022

Why Tally on Cloud post Covid - 19?

Covid-19 brought the world to a standstill. But we have now moved past that and today all Indian markets are running as they were before the pandemic. The pandemic brought in the work from home culture and hence businesses started using Tally on Cloud. But now that the markets are up and running, most employers have asked to resume working from the...

- August 30, 2022

The quickest way to shift from Quickbooks to Tally

A tally is software that does not need an introduction. Every business has either used Tally, is using Tally or is planning to use Tally. Over the last 3 decades, businesses, accountants, CAs and business owners have increased the demand for the usage of Tally Prime considerably. Even though over the years, new business management and accounting software like Quickbooks...

- August 20, 2022

How have QR codes with UPI payment in Tally invoices benefited businesses?

India in a month transacts over 10crore worth of transactions using UPI. This value has been continuously progressing over the last few months. UPI has truly made our economy paperless. People are paying using UPI not just for big amounts but also for single-digit value transactions.UPI in the business world too has progressed considerably...

- July 30, 2022

E-invoicing in Tally for B2B Businesses

E-invoicing is slowly being extended to more and more businesses. E-invoicing is no new concept. Introduced in the year 2020, E-invoicing promises to eliminate all types of GST frauds. How? E-invoicing ensures all your invoices are made using a unique invoice Registration Number (IRN) generated from the IRP (invoice Registration Portal) after verifying its genuinity...

- July 15, 2022

Top 6 productive hacks for Tally Prime

Tally is being used by over 2 million users worldwide. This is mainly due to its usability, simplicity, flexibility, and ability to adapt to unique businesses. Tally is mainly a business management software and thus businesses are almost completely reliant on Tally for their day-to-day functioning Businesses can choose from a variety of different accounting...

- June 30, 2022

3 Ways You Can Boost Your Tally Security, Performance and Reduce Overall Costs

Tally is being used by over 2 million users worldwide. This is mainly due to its usability, simplicity, flexibility, and ability to adapt to unique businesses. Tally is mainly a business management software and thus businesses are almost completely reliant on Tally for their day-to-day functioning...

- June 30, 2022

10 Features Your Tally On Cloud Must Provide

Is your Tally on Cloud or On Premise? Can you access your Tally from any device? Most successful businesses access their Tally on Cloud as per their convenience from anywhere and at any time. The main reason that makes such businesses successful is the growth mindset and the willingness to adapt to the evolving new technology...

- May 31, 2022

Why Excel to Tally Import Utility Is Better Than Manual Data Entry?

There is no doubt we all are moving towards automation. We use washing machines and dishwashers to save time spent on manually washing clothes and utensils.The time saved is then used in a more productive chore that may be more skilled and more human-dependent...

- May 31, 2022

How to choose between TallyPrime 2.1 Edit log and TallyPrime 2.1?

Tally Prime 2.1 is the latest version of Tally introduced in the month of March 2022. This is a major update and has some of the best features in Tally making it an even more useful software for business management...

- April 13, 2022

How to Implement Edit Log and Digital Signature in Tally Prime

Edit log and Digital signature are two of the most useful features introduced in the latest release of Tally Prime 2.1. There are two versions of the latest tally prime one with mandatory Edit log and one that has an option to enable or disable Edit log..

- April 13, 2022

Difference Between the Two Versions of Tally Prime 2.1

Tally is constantly updating and upgrading itself to stay relevant and useful as per the changing business scenarios. Constant addition of new features and 100% statutory compliance of Tally has made it one of the most used software for accounting in India...

- March 22, 2022

How Tally Prime helps manufacturing Industry

The Manufacturing Industry is one of the first industries to have adopted software for its resource management. The reason being the complicated nature of the processes and decision making involved in a manufacturing business...

- March 22, 2022

6 Mistakes to Avoid in Inventory Management

Inventory or stock is the core of most product based businesses. Storage and processing of this stock to develop the final sellable product requires efficiency so that the input is minimum and the output is maximum...

- Feb 22, 2022

Compatibility and Tally - 4 Ways You Can Integrate Your Tally

Digitization has caused businesses to use multiple software in different areas of work. Different software, websites, excel sheets hold a lot of business information. Tally being an accounting software that needs to have all accounting data...

- Feb 22, 2022

Automation Possibilities in Tally

Business automation is the key to reducing unnecessary costs and maximising productivity. Tally itself is an automating tool that automates various business processes like stock management, accounting, HR activities, etc...

- Jan 28, 2022

How Tally on Cloud has Helped Thousands of Customers

Tally is known for its simplicity. It offers all types of business management features in one software. By default, it’s an offline software and can be accessed on different PCs only through LAN connection...

- Jan 28, 2022

Barcode and Inventory Management in Tally for Small Businesses

Data entry is one of the most human dependent and time-consuming tasks. Every business starts with manually handling tasks and as the business grows it starts to automate functions that are repetitive and are monotonous in nature...

- Dec 31, 2021

Provisions for Payment Recovery and Outstanding Management in Tally

Tally, a business management software, is known for its accounting capabilities. This is because most businesses using Tally appreciate the statutory compliance that Tally provides along with the other accounting features...

- Dec 31, 2021

Rack/Bin Wise Stock management in Tally you must know

Labels make everything look organised as well as makes the process of locating things easier. Labeling especially becomes essential when there are a large number of products spread over large spaces...

- Nov 30, 2021

How to start accounting for your startup business in just Rs.600

Starting a business requires you to juggle between a lot of departments especially if you’re the sole owner of a business....

- Nov 30, 2021

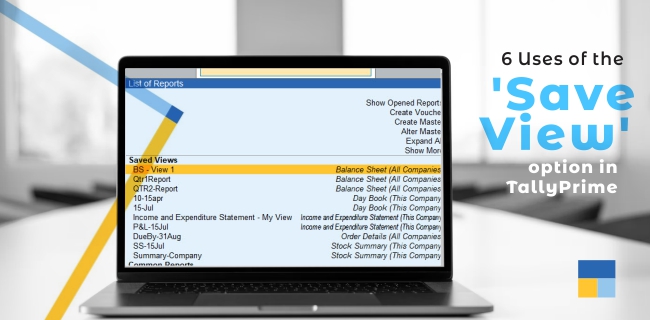

6 Uses of the ‘Save View’ Option in TallyPrime

Reporting of every business is different . A standard report cannot be used by every business. Businesses use different filters and views to view reports...

- Oct 23, 2021

Why should you have a QR code in your Tally invoice?

As the world gets more and more technology-driven, we see how the use of QR codes is increasing day by day. QR code means quick Response code...

- Oct 23, 2021

Top 7 Inventory Management problems faced by businesses and ways to solve them

One important reason Inventory must be efficiently managed is, the success of all product based businesses highly depends on how well their inventory is managed...

- Sept 31, 2021

Top 10 shortcuts in Tally Prime every accountant must know

Here are some Tally Prime shortcuts that every accountant must know to speed up their work while using Tally...

- Sept 31, 2021

Send Tally Invoice and documents anywhere anytime

Working offsite? Here’s how you can send invoices to your stakeholders at any time and from any device using Tally...

- Aug 21, 2021

TallyPrime on cloud and its usefulness

Here is how TallyPrime on Cloud will help you as a Tally user while working away from office or from a Mac book PC...

- Aug 21, 2021

Is your Tally.ERP 9 Outdated?

Are you using an outdated Tally.ERP 9 software? Move on to a better and simpler Tally prime software for better efficiency and speed...

- July 05, 2021

5 Ways to avoid bad debts for SMEs

Bad debts are those debts that are labeled as unrecoverable. Often there’s a credit period that is given to customers within which the sellers expect the customer to pay....

- July 05, 2021

Why is Excel to Tally tool a must-have for businesses today?

Accurate data is vital for businesses to understand their customers better. Tally is a storehouse of all the business transactions and other customer data....

- May 27, 2021

Affordable way of boosting your tally performance

Businesses have been using Tally for years now. Since 1989, the year Tally was founded, many businesses are still using Tally. It has stayed and has grown...

- May 27, 2021

How Tally on Cloud helps your business run seamlessly

Work from home culture is here to stay. Before the pandemic started back in 2019, the thought of employees working from home was not favored...

- May 06, 2021

Don’t buy Tally on cloud until you know this

Tally on Cloud technology has been a saviour for many businesses in the current pandemic. Lockdown has forced companies to work remotely from their home space...

- April 26, 2021

Local server VS Cloud server

Data is rightly said to be the lifeline of a business. Continuously data is being collected and stored by businesses to keep records...

- April 26, 2021

Tally integration with SAP and other Business Intelligence software

Integration is simply the exchange of data between software for better comprehension of the available data. Data plays a vital role in critical decision making...

- March 24, 2021

What does it mean to customise your Tally?

An invoice may seem like a simple piece of document used as a receipt or to get paid. But it is much more than that; it is the face of the business....

- March 24, 2021

Standard Invoice VS Personalised or Customised Invoice

An invoice may seem like a simple piece of document used as a receipt or to get paid. But it is much more than that; it is the face of the business....

- Feb 27, 2021

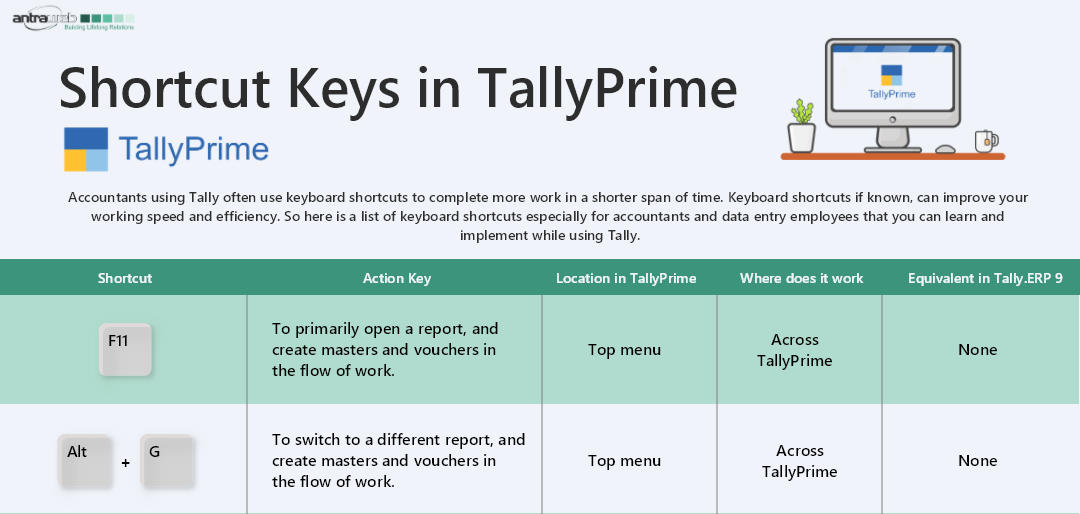

Useful Shortcut Keys In TallyPrime

Accountants using Tally often use keyboard shortcuts to complete more work in a shorter span of time. Keyboard shortcuts if known, can improve your working speed and efficiency...

- Feb 10, 2021

Impact Of Union Budget 2021-22 On SMEs

SMEs in India are considered the backbone of the socio-economic development of our country. An estimated 45 million SMEs provide a significant number of jobs, services...

- Jan 20, 2021

Impact of E-invoicing on businesses

E-invoicing is the latest addition under the GST Act. It may soon be extended for all B2B businesses, starting from 1st April 2021 as per the authority's latest notification...

- Jan 20, 2021

Introduction to Tally Prime Server

Tally solutions had last year released one of the biggest upgrade of Tally.ERP 9 i.e. TallyPrime. Hereafter, all new releases will be called Tally Prime instead of Tally.ERP 9. ..

- Dec 21, 2020

E-Invoicing In Tally

In the past few years, there have been many changes in the tax system in India. After the introduction of GST few other statutory elements like the E-way bill and E-invoicing were added....

- Dec 21, 2020

TallyPrime - A Tally Version For Both Business Owners And Accountants

TallyPrime is the latest version of Tally. It is one of the biggest Tally upgrade. Most accounting and ERP software are considered accountant friendly...

- Nov 18, 2020

How to Upgrade Tally ERP 9 to Tally Prime?

Tally ERP 9 is the most commonly used accounting and business management software. It was the first-ever accounting software made in India...

- Nov 18, 2020

How to download and install Tally Prime?

The most awaited release of Tally, TallyPrime is here. Get a detailed comparison of Tally.ERP and TallyPrime here. The new look and navigation system in TallyPrime is amazing...

- Oct 19, 2020

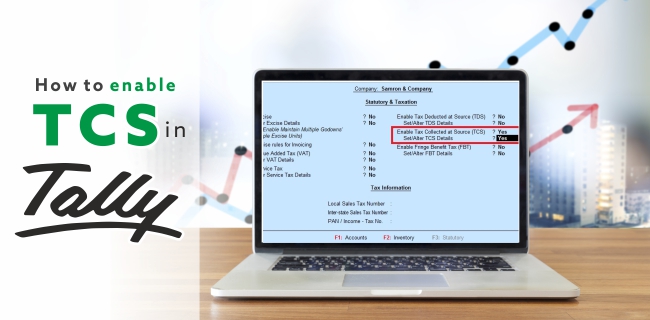

How to enable TCS in Tally?

TCS (Tax Collection at Source) is newly introduced on Sale of Goods starting 1st October. This blog shows you how to enble and implement TCS in Tally....

- Oct 16, 2020

Step-wise E-way Bill generation in Tally

E-way bill is required by most businesses. Here’s a step-wise guide to help you generate E-way Bill in Tally...

- Sept 26, 2020

Are you Tally Prime ready?

Tally Prime is the most discussed topic these days. Everybody knows it is the most significant update in the history of Tally...

- August 14, 2020

Tally On MAC

Tally ERP 9 is a software that can be used only on Windows operating system. In this blog we will see how Tally can be used on Mac...

- August 14, 2020

Guidelines for Setting a Strong Password

Far too many businesses set a password that can be easily hacked. Here are few guidelines and tips on setting a strong password...

- July 15, 2020

Tally in a Virtual Environment

Tally has always been an on-premise software. But over time, many users have been trying to use Tally online either through third-party applications or through cloud technology...

- June 19, 2020

Befikr Business Karona

If you ask me one thing that I never thought would be normalized anytime soon then, it is the concept of work from home in India. While work from home is a common concept in the developed nations like the USA, in India, it was rarely an option...

- May 18, 2020

4 Features to protect your Tally data while working remotely

Businesses today are left with no option but to work from home due to the COVID - 19 situation. While it may seem unfair, but every business right now is going through the same situation. It’s essential to make a note of how these businesses are surviving and tackling the various problems that arise regarding data safety and employee performance...

- April 14, 2020

5 solutions to take your office to your home

At present, businesses want to work from anywhere and at anytime. Few decades ago this was not possible but today it is possible due to a number of IT software. This blog will help your business work remotely by giving examples of software that can be used to work remotely.....

- March 15, 2020

Excel to Tally - One stop solution for all Types of Data import

Businesses are using multiple software to suffice their unique business requirements. In such situations maintaining the integrity of data becomes extremely important. Here’s a good read about how Excel to Tally will help you in all types of data integration in Tally....

- Feb 15, 2020

Decision making through Tally

Decision making is simple and quick through Tally. As Tally provides detailed reports that provide the necessary insights required for effective decision making. Read to know about the important reports in Tally that are perfect for decision makers...

- January 16, 2020

Key features of Tally that Business Owners must know

Running a business is equivalent to working at 5 different companies with jobs in 5 different departments. You have to pay attention to each and every department of your organization and continuously measure and control the activities to ensure the highest level of productivity....

- December 04, 2019

Accounting Complexities of an Online Seller

While managing an Online business may seem easy, the real challenge lies in the accounting of the business. There are many complexities that an Online or e-commerce seller faces. In this Blog, Mr. Nevil Sanghvi, the Director of Antraweb Technologies Pvt. Ltd. and Vice President of Bombay Industries Association (BIA)...

- November 15, 2019

Reporting in Tally ERP 9

Reports are an essential part of every business be it a startup or an MNC. Reports provide you an overview of the current situation of the business or a project. An overview provides you with the support required to take a decision in the most accurate way possible...

- October 15, 2019

Automation - The future of E-commerce

The e-commerce business in India is experiencing a tremendous boom due to the increase in the number of internet and smartphone users. Along with the favorable internet services provided at reasonable costs. More and more of the population is purchasing through e-commerce websites. ...

- September 15, 2019

Things you must know while managing multiple Branches in Tally

Companies grow and expand over time. A company may start with a single user and may grow to multiple users in a LAN connection or even to multiple locations across the country...

- August 15, 2019

With Tally don't work twice!

Data is exploding, data is everywhere. But this data is useless if it is not structured. Structured data is information that helps to take important decisions. Tally data as we all know is valuable and is considered the heart of a business...

- July 15, 2019

What measures have you Taken for your Tally Data Security?

Imagine one day you wake up and all your Tally data is gone! Does it sound as scary as a burglar attack into your house or is it scarier? Well, it depends..if you do have a backup in place you wouldn’t panic as much as in a situation of burglar attack. ...

- June 15, 2019

11 features in Tally for a manufacturing business

Manufacturing involves the movement of many goods including raw materials, semi-finished and finished goods. Keeping a track of these goods manually is a very daunting task. Also not to forget, keeping a track of ...

- May 06, 2019

3 Features in Tally that you can activate to cut business costs

According to Bloomberg, 8 out of 10 small businesses fail within their first 18 months the reason being most entrepreneurs focus on maximizing sales while neglecting the extra expenses which is equally important while trying to achieve profitability...

- April 18, 2019

.jpg)

Best time to shift from manual accounting to Tally

This is the best time to leave behind your old ways of accounting and move towards automated accounting or computerized accounting. Tally itself has more than a million customers worldwide.

- March 23, 2019

Key things to take care of before the start of new financial year

The new financial year is just around the corner and it is the perfect time to plan and make yourself ready for seamless transition of your company data into the new financial year using Tally.ERP 9...

- Feb 13, 2019

Beyond Tally features needed in your growing business

What if I told you, at the end of this blog you will be able to save all your bills and supporting documents in your Tally along with their respective entries without paying a single rupee? Or... Even better as an administrator you'd be able to monitor the user activities while they use Tally? ...

- January 25, 2019

Enterprise version of Tally

With the growing business comes the need of enterprise software which not only accelerates the efficiency and productivity of the business but also help solve problems which can have huge impact to the business, if not taken care at the right time...

- December 19, 2018

SMS vs WhatsApp - Who is winning in the battle of business communication?

Today, communication has become one of the most powerful and effective modes for transacting, interacting and engaging with business, customers or any individual. In today’s technology-driven world there are multiple apps...

- November 19, 2018

Importance of software free trial

Tally has become an integral part of business. It is one of the best software used for managing accounts. Several start-ups along with small and medium enterprises use Tally to carry out day-to- day transactions. The software can maintain records, generate invoices, ease billing process, calculate GST and other applicable taxes. The company has recently introduced...

- November 16, 2018

Uses of Latest Tally Software

Tally software is a useful tool that handles accounts, tax management, inventory management and payroll. The software has single-user and multi-user licenses beneficial for small and medium-size enterprises. It eases out complex calculations and gives accurate results. It proves to be time saving and simple as the software can be learnt by new users as well as accounting experts...

- October 15, 2018

6 Reasons You Should be Sending SMS to your Customers

Messaging your customers is one of the best ways to connect with your customer. Today customers are not brand loyal they are ready to switch at the smallest of discomfort. Only because there are too many substitute Vendors out there in the market place. The only way you can keep your customers hooked today is by building a relationship based on trust...

- September 21, 2018

Advantages of using Tally in Small Businesses

Tally is an accounting software that has made calculations simple. It has become a part and parcel of all businesses. Small scale enterprises believe that Tally software saves a lot of time, provides accuracy and carries out efficient business transactions...

- August 21, 2018

The impact of GST on Tally Software

The year 2017 has given all of us the largest tax reform known as the Goods and Services Tax, popularly called GST. It is divided into five slabs that has separated various commodities and levied different rates on products belonging to different categories. GST is being collected by small, medium and even large enterprises. Accounting...

- July 27, 2018

Key Enhancements of Tally.ERP 9 Release 6.4.6

Tally ERP 9 software has become a name synonymous with GST for its GST-compliance. This software is now the confirmed option for GST-compliance. Since the introduction of GST and E-Way Bills in India, Tally software and its latest versions are gaining more significance. Some of the latest versions of the Tally ERP 9 software are...

- June 22, 2018

Find Out How Tally Is Much Better Than An Accounting Software

Tally is definitely not a mere accounting software! With its high capabilities and features, it is much beyond that. Tally has myriad features besides its accounting feature and there is no reason why the Tally software is so popular. Let us explore most of the versatile features and have a good insight into the significance...

- May 23, 2018

How Tally.ERP 9 Is Facilitating Easy GST Compliance

Tally is GST-ready! Tally.ERP 9 software is GST-ready. The Tally software facilitates easy management of financial data in GST regimes, even in the midst of a financial year. Business owners are required to provide only the date of commencement of GST for the specific set of transactions and GST becomes applicable only for these transactions...

- April 25, 2018

Good News! Tally’s New Launch – Effective e-Way Bill Software

Good news for new age-businessmen and entrepreneurs! The business software provider Tally has launched its latest software Tally.ERP 9 Release 6.4 for effective eWay Bill compliance. The product is priced at Rs. 18,000-plus GST for a single user edition and Rs. 54,000-plus GST for a multi-user edition. The latest release Tally.ERP 9 Release 6.4 is ...

- February 15, 2018

Major e-way Bill Notifications Under GST

The major GST recommendations with regards to the e-way bill notifications are as follows: The nationwide e-way bill system will be rolled out on a trial basis, latest by 16th January, 2018, post which traders and transporters can start using this system on a voluntary basis. The detailed rules for implementation of the nationwide e-way...

- January 19, 2018

How Do Businesses Help Tally AMC / Annual Support Cover?

There are several Tally services that are available with Antraweb and one of them is Tally AMC/Annual Support Cover. Tally AMC/Annual Support Cover is a business continuity support system for your company from a group of experts who knows Tally well...

- December 19, 2017

How Do CAs Benefit From Tally ERP 9 Auditor’s Edition?

What is Tally ERP 9 Auditors Edition? Well, it is a tool that is required for business functions for both the clients as well as CA’s. It comes with several services that deeply add value like remote access and persistent statuary compliance. This product is unique in the market for it continues to increase the...

- November 21, 2017

How Tally Shoper 9 Can Help The Retail Industry

Tally Shoper 9 Being one of the products of Tally ERP 9, Tally Shoper 9 is known to deliver superior and smooth support for business operations to users. It is utilized by retail firms of different sizes. After an elaborate and comprehensive research, the product was developed to offer support when functioning simultaneously with huge...

- October 27, 2017

How GST Affects The Media And Entertainment Industry

GST Background What do we know about GST? The Goods and Services Tax (GST) is an indirect tax, pertinent all throughout India. It has taken the place of numerous cascading taxes charged by the state and central governments. Entertainment and Media Industry Growth As we know, the entertainment and the media industry in India is...

- September 26, 2017

How Has GST & Tally Simplified Things For Businesses?

It’s been more than 2 months after the launch of GST (Goods & Services Tax) in India, touted to be the biggest tax reform in India since independence. Though there have been little hiccups, overall the transformation from the previous tax regime to the new one has been smooth. Businesses are slowly but steadily getting...

- August 14, 2017

How to File Return with GSTR -3B Filing?

Recently, the Indian Government came up with a GSTR 3B form for the Businesses to file their return only for the initial 2 months of GST implementation. This specific form declared by the government is to be filled up for the month of July and August 2017 instead of the normal return forms (GSTR 1,...

- July 20, 2017

What Impact has GST brought on Vendor Management?

GST is not just a tax reform but a business reform and in the near future it’s definitely going to change the way business decisions are made as far as selecting vendors and procurement of goods/services are concerned. After the introduction of this tax reform, India will be one market and there won’t be any...

- June 27, 2017

What Impact would GST have on Manufacturers?

GST is a Goods and Services Tax that has been put forth by the Government of India and will be implemented from 01st July 2017. Experts opine that this tax reform will have a positive impact on all types of businesses provided they adhere to its terms and conditions. With the ‘Make in India’ campaign...

- May 22, 2017

Expectations From GST Regime

Just few weeks remain for a nationwide GST rollout and there would be several questions hovering over the mind out of which one would be ‘What to expect from the GST tax structure and what changes would I need to make in my system to adapt to the new tax regime? This blog will stress...

- March 23, 2017

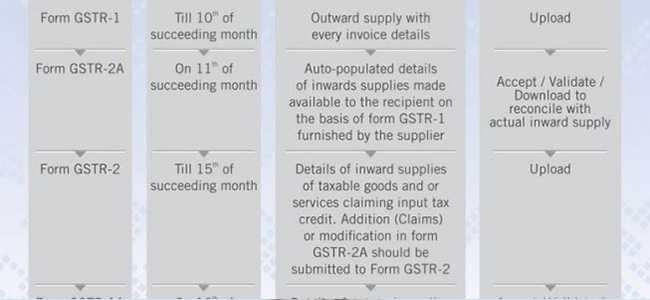

Just Few Months for GST Rollout! Are you Ready?

Indian Businesses are eagerly waiting out for the rolling of Goods & Service Tax (GST) which will be effective from 01 July 2017. With majority of the businesses using Tally Accounting software for daily functioning, integrating GST with it won’t be a problem. Under GST, businesses need to file 3 types of Returns per month,...

- March 17, 2017

How would GST impact various Sectors in India?

With GST (Goods & Services tax) coming in few months from now, it’s surely going to be a revolution that would change the dynamics of Indian tax system. This tax system would create a platform wherein India would be a one common market and the businesses would be at ease to function with big savings...

- February 17, 2017

How Useful is ERP integrated with Tally beneficial for Pharmaceutical Industry?

ERP is referred to as Enterprise Resource Planning wherein Enterprise is your business organization, resource are the employees, finance and infrastructure and the resources are planned to get the best possible results for the business. The main purpose of the ERP software in an organization is to eliminate the practice of manual process of working...

- January 20, 2017

Tally ERP 9’s Release 5.4 – A Better way to Get Ready for GST

Tally ERP 9’s latest release 5.4 rolls out integrating GST bill amendment. As India is preparing for the biggest tax regime in Indian Taxation history and the scenario of different taxes per state is going to end soon, Tally ERP 5.4.3 is all set to cover up. This latest release of Tally’s most popular version...

- December 28, 2016

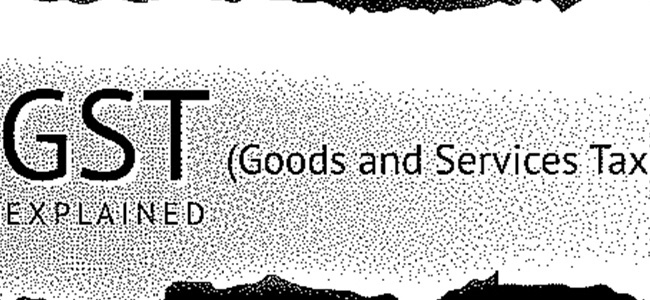

A Simplified Version of GST for Indian Business Users

Recently the GSTN Network announced Tally Solution as a Goods and Services Tax (GST) Suvidha Provider. Quite overwhelmed with this announcement, Tally Solutions launched a GST mobile application to ensure easy adoption of the technology led tax law. A claim by Tally reveals that the mobile application is a rich source of information on GST ...

- December 9, 2016

Table Search and Contains with Search in Tally ERP 9

The famous Tally ERP 9 accounting software has the search facility to let users filter Groups, Ledgers, Inventory, Voucher Types, etc. When the user enters a text in the field for the selection of an item from the list, he will get a filtered list based on his text entered in field using the Starts...

- November 17, 2016

How does Tally Impacts Businesses of Organizations?

Tally ERP 9 solution has been a cornerstone for businesses to see a positive growth in the last few decades. For Tally Solution, it has been possible due to following reasons: Through Tally ERP 9, the time taken to market for businesses can be lessened from 3 days to nearly 1 day thus enhancing efficiency...

- September 28, 2016

What Differentiates GST from Current Tax Structure?

GST which is the abbreviation for Goods & Service Tax is a single unified tax system introduced by the Government of India. The purpose of this tax system is to unite India’s complex taxation structure to a ‘One Nation-One Tax’ regime. It’s termed to be the biggest tax reform since India got its independence. Many ..

- September 27, 2016

Latest Features of Tally ERP 9

Tally ERP 9 has been a revolutionary version of the highly popular software with its state of the art features and effectivity. Many small, medium and big sized businesses globally use Tally for their daily business functioning and the number has now crossed several millions. The latest version of this software has created new heights...

- August 26, 2016

How to Manage Payroll in Tally?

The term ‘Payroll’ is mainly referred to a series of accounting transactions involved in the process of paying employees for the services rendered after taking all the statutory and non-statutory deductions into account. It’s a tough job to manage payroll in any organisation and constitutional compliance make it more complex as well as difficult. Payroll, ...

- August 19, 2016

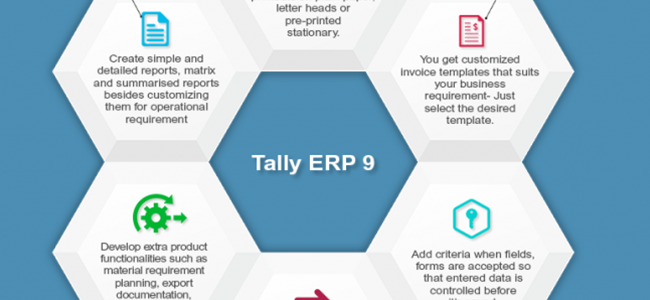

Significance Of Tally Customization For All Types Of Businesses

Tally Solutions has been in business for numerous years and have catered to a wide variety of clients globally. Today, it powers more than 10 lakh businesses worldwide which is no less achievement.Tally products are playing a significant role in transforming businesses across industries in more than hundred countries. In India, Tally caters to almost...

- June 29, 2016

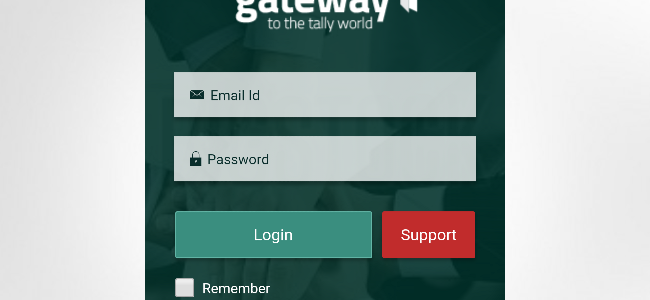

Conventional Tally Support Vs. Modern Day Tally Support – Infographic

Tally Gateway App – An Overview Tally Gateway App is truly a Gateway to the Tally World. Developed & Launched by Antraweb Technologies, this app allows: To login and raise your query/complaint To give the subject and short description about the query/complaint To view company profile in My Accounts and change the login password often...

- June 24, 2016

Antraweb Launches Tally Support App – ‘Tally Gateway App’

Antraweb Technologies having a rich experience in the implementation of Enterprise business solutions in Tally Enterprise Framework provides complete Tally solutions including design, development, consultancy, implementation as well as training. They add productivity to their clients by bringing outstanding understanding of the business processes to the table. In their pursuit of continuously enhancing their products...

- May 24, 2016

Buying A Pirated Tally – An Unprofitable Deal

Tally Piracy With a non-licensed Tally version, you have all the freedom of a licenced Tally but you will miss something. Few basic setbacks you may come across: You may not get instant support when Tally Application crashes Trouble in recovering Data Loss Issues in updating to higher versions and modules. Benefits of Having A...

- May 10, 2016

Why It’s Essential To Renew Your Tally.Net Subscription?

Irrespective of how genuine and professional the business is, the fact is that it can’t afford to use an outdated and pirated accounting software. Renewal of Tally.Net subscription aids to get the updated Tally ERP 9 software along with several other features such as remote edit, managing your subscription and several other facilities which will...

- April 29, 2016

Tally ERP 9 Customization Process – Infographic

What is Tally Customization? Tally ERP 9 comes built with an unbelievable range of features, functions and capabilities needed for business of varied sizes – be it small, medium or large. However, businesses regardless of their size have their own particular requirements that need to be done by modification in Tally Software. This modification is...

- March 15, 2016

Is Tally Being Used To Its Complete Potential?

In today’s rapid developing scenario more and more businesses are being set up to cater the unending needs of consumers. As the number of businesses coming up have considerably increased, the need for efficient management of those businesses have also gradually grown up. In this time of digitization, with the use of software, handling a...

- February 25, 2016

Why Should You Use Tally Mobile App?

Mobile apps are used widely today for effective business management and communication. The growth of smartphones accelerated the development of industry specific mobile apps. Since, Tally ERP 9 is one of the most widely used ERP, the need for Tally app for mobile became indispensable. Tally mobile apps from Antraweb give much more flexibility to...

- February 8, 2016

How Small Business Owners can benefit from Basic Accounting Tips

You have a lot to think of as a business owner and in that if you own a small business then the entire responsibility lies on you. When you are accountable for a business, business accounting is one of the key things which you need to handle. You ought to know the ways to handle...

- February 5, 2016

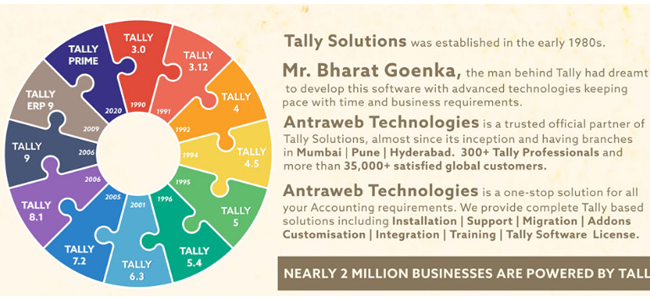

Evolution of Tally ERP 9 – Infographic

Evolution of Tally ERP 9 Tally Solutions was established in the early 1980s. Mr. Bharat Goenka, the man behind Tally ERP 9 had dreamt to develop this software with advanced technologies keeping pace with time and business requirements. Antraweb Technologies is an trusted partner of Tally Solutions almost since it’s inception and having 6 branches,...

- February 3, 2016

A Detailed Overview of Tally

Many of you must have heard the word Tally for years now. Some know what it means while others aren’t aware of what it’s all about. It’s nothing but an accounting software for small and medium organizations. It does each and every function of accounting that a mid-sized organization is into. This is what most...