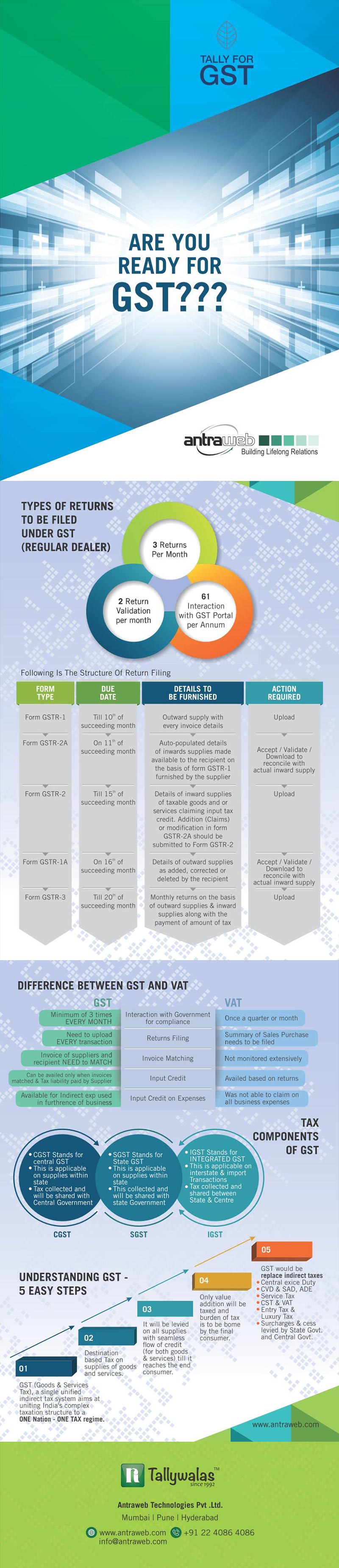

Indian Businesses are eagerly waiting out for the rolling of Goods & Service Tax (GST) which will be effective from 01 July 2017. With majority of the businesses using Tally Accounting software for daily functioning, integrating GST with it won’t be a problem. Under GST, businesses need to file 3 types of Returns per month, with 2 Return Validation per month and 61 Interaction with GST Portal per annum.

GST is already compliant with Tally in countries such as Singapore & Malaysia and so it won’t be difficult for Tally to be GST compliant in India. GST’s compliance with Tall is quite beneficial. Till date, businesses were filing returns manually which was a tedious task, but now they would require a software such as Tally to automate their return filing which will save a lot of time. Also, filing 5 returns per month with Tally will get extremely easy when compared to manual filing and that too with highest level of transparency.