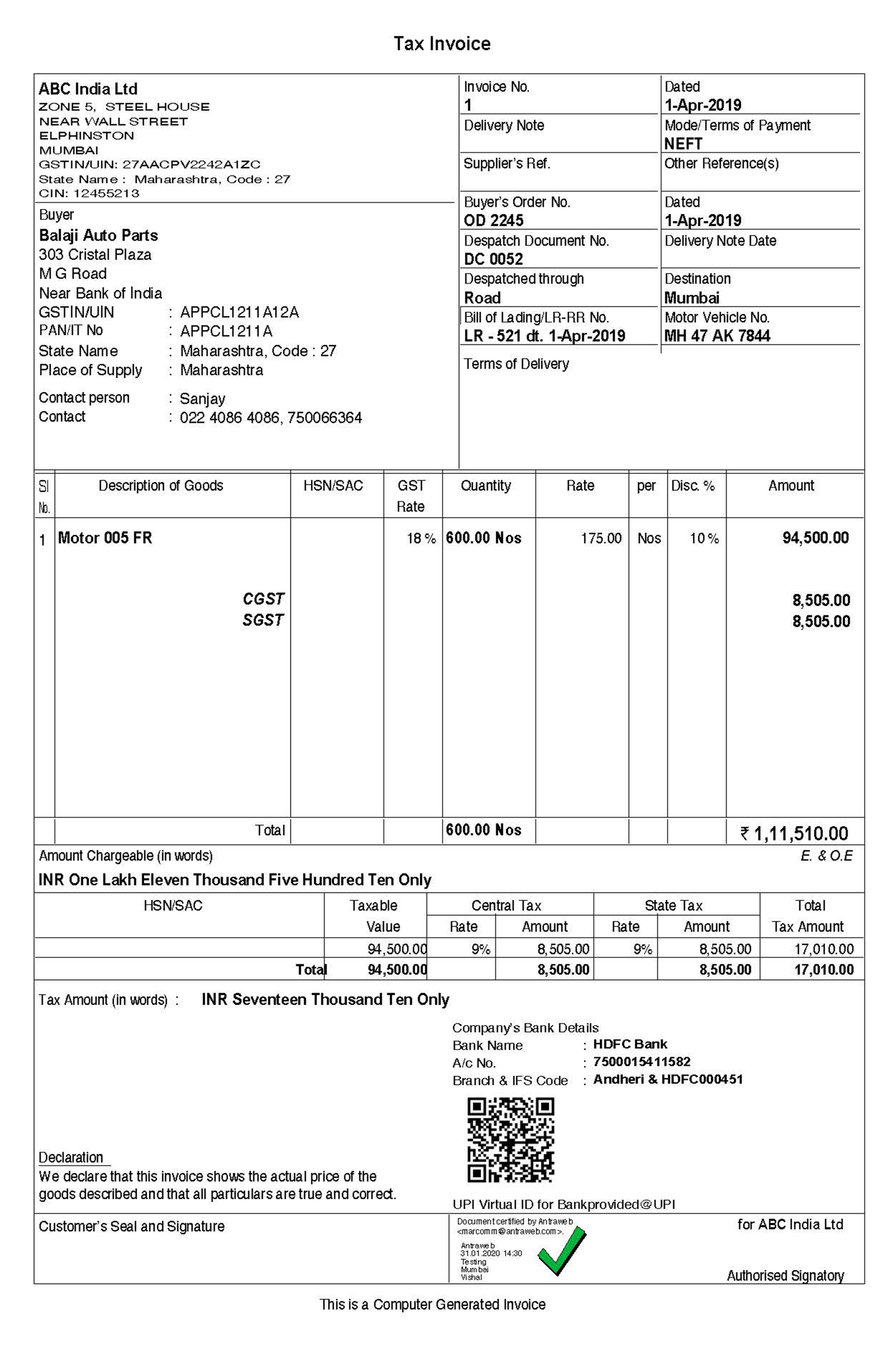

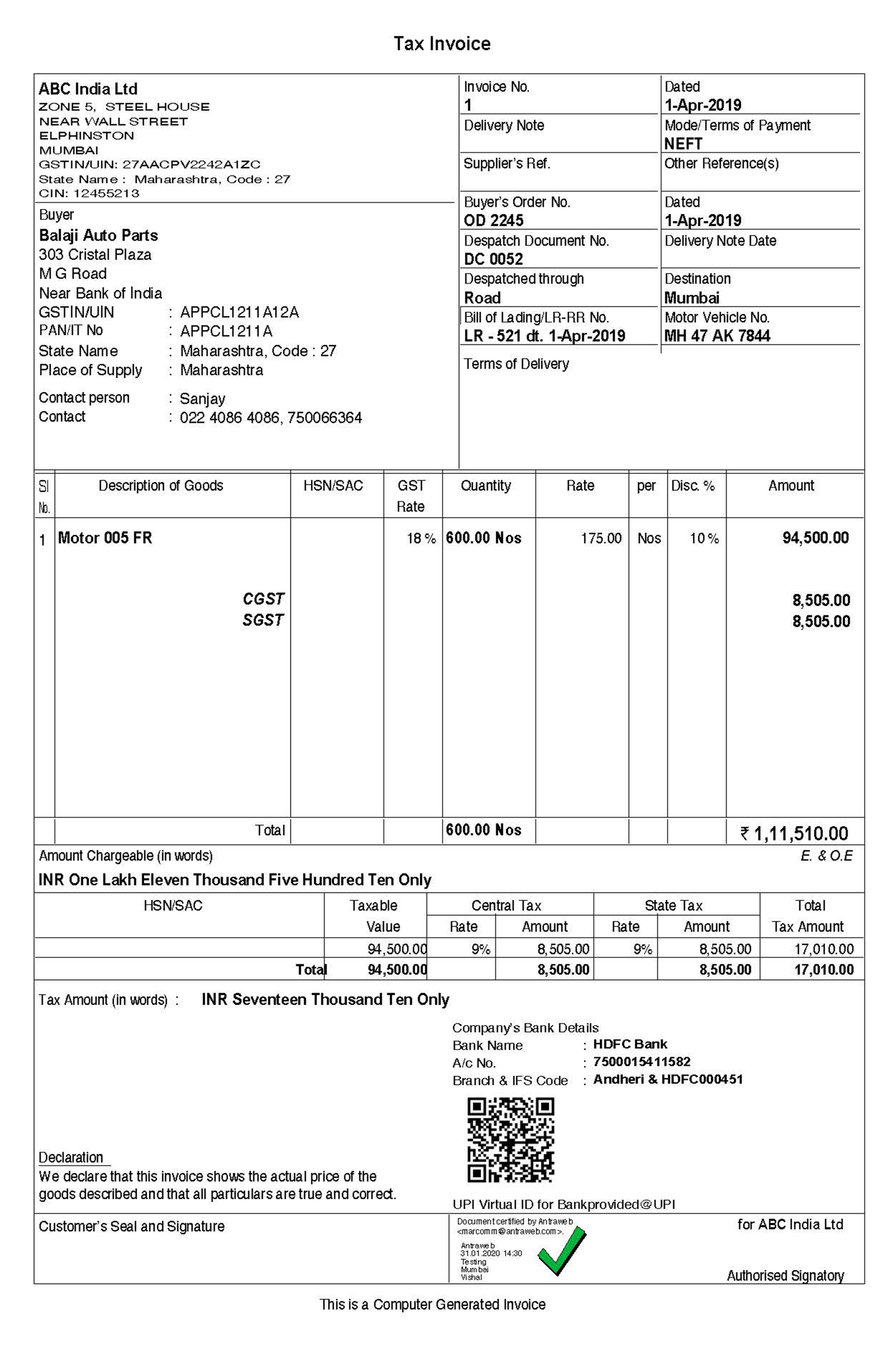

Generate e-payment base QR-Code invoice from Tally.ERP 9

Error!!! Please fill the required fields

The GST council has approved GST E-payment invoice for Individual, HUF, Company, LLP or having any other status (irrespective of whether resident or not) if they are carrying business and if his total sales, turnover or gross receipts, as the case may be, in business exceeds fifty crore rupees during the immediately preceding previous year. E-payment invoice provides option for digital mode of payment.

Yes, it is mandatory businesses earning 50 cr and above turnover. GST E-payment invoices are introduced to promote digital mode of payment.

Yes there is a penalty of Rs. 5000 per day starting from 1st February 2020. Any business failing to make provisions for GST E-payment in Invoice may face penalty.

Following are the benefits-

Due to the growing demand from more and more Tally users for GST E-payment invoice, Antraweb has already started designing E-payment invoice formats for Tally users which can be generated from Tally.ERP 9 itself. To get this GST E-payment invoice in Tally.ERP 9, contact us.