The Hidden Gap in Tally

Most businesses in India depend on Tally for their day-to-day accounting. Bills, ledgers, GST returns, balance sheets - everything flows through it. But here’s a reality we’ve observed in our 33+ years of working with Tally users: many still don’t realize that just buying Tally is not enough.

You may be entering vouchers, generating invoices, or filing GST returns regularly, but when government rules change overnight or when you need urgent access to data outside the office, Tally alone may leave you stuck. This is where Tally Software Services comes in.

Unfortunately, many businesses either forget to renew their TSS on time or assume it’s only about “getting the latest version.” The truth is, TSS is your lifeline for compliance, connectivity, and smooth business operations. Without it, you’re using only half the power of Tally.

What Exactly is TSS?

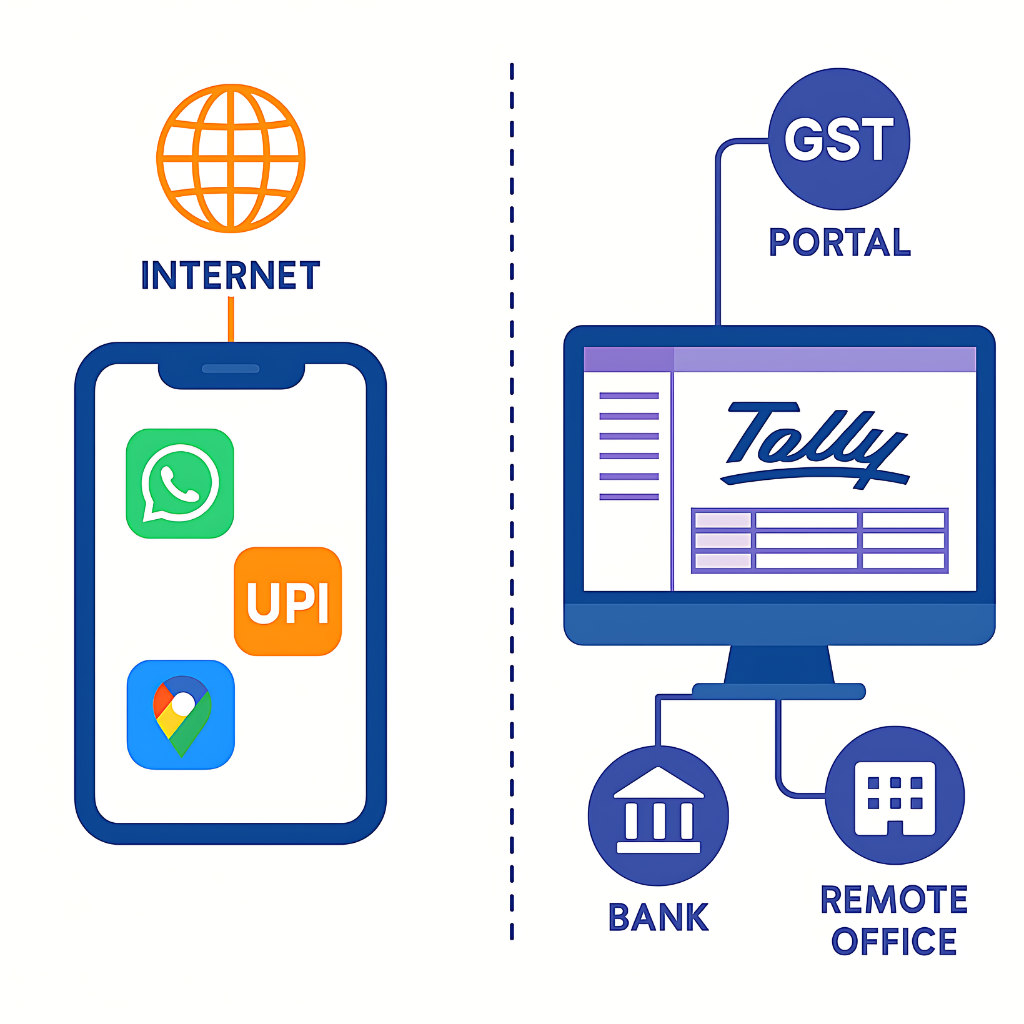

Think of TSS in Tally as an annual subscription that keeps your Tally connected with the outside world. Just like your smartphone needs the internet to run WhatsApp, UPI, or Google Maps - your Tally needs TSS to connect with GST portals, banking systems, and even your own branches.

It’s not an add-on luxury; it’s the backbone that ensures your Tally is legally compliant, always updated, and accessible. Whether you’re a small shop, a manufacturing unit, or a CFO of a growing enterprise - TSS quietly keeps your business running without interruption.

Why TSS is More Than Just Updates?

Many business owners ask us: “Why should we pay every year? Our Tally is already working fine.”

Our answer is simple - Tally without TSS is like driving a car without insurance — it may run today, but the moment something unexpected happens, you’ll regret not having it.

Yes, TSS provides regular product Tally updates - but that’s only one part of the story. The real advantage is that it keeps your business connected to real-time compliance (GST, TDS, e-invoicing), enables smoother operations like e-way bills, and gives you 24×7 secure Tally remote access to your data even outside the office.

In today’s environment, where tax rules change constantly and businesses are spread across multiple locations, TSS is not optional - it’s essential.

The Real Benefits of TSS

Let’s go step by step into what you actually get with TSS and why each feature matters.

-

e-Invoicing and e-Way Bills - No More Manual Work

Earlier, generating e-invoices or e-way bills meant manually logging into government portals and re-entering data - time-consuming and error-prone. With TSS, invoices created in Tally can directly become valid e-invoices or e-way bills with a single click. Bulk generation, editing, or cancellation is also seamless.

✅ For transporters: trucks don’t get delayed because of paperwork.

✅ For accountants: no repetitive manual work.

✅ For owners: peace of mind that compliance is done right.

-

Remote Access & Browser Reports - Tally on the Go

Think about this: you’re traveling for a client meeting, and then suddenly someone asks, “Can you share last quarter’s sales report?” Normally, you would call your accountant, ask them to email it, and wait. With TSS, you can simply open your laptop, tablet, or even mobile browser, log into Tally, and the report is there in real time.

It’s not just viewing - it’s real-time secure access. You see exactly what’s in your office Tally, updated till the last entry. We’ve seen many CFOs check their P&L at night from home, and owners monitor outstanding reports on the road. That’s the convenience TSS quietly provides.

-

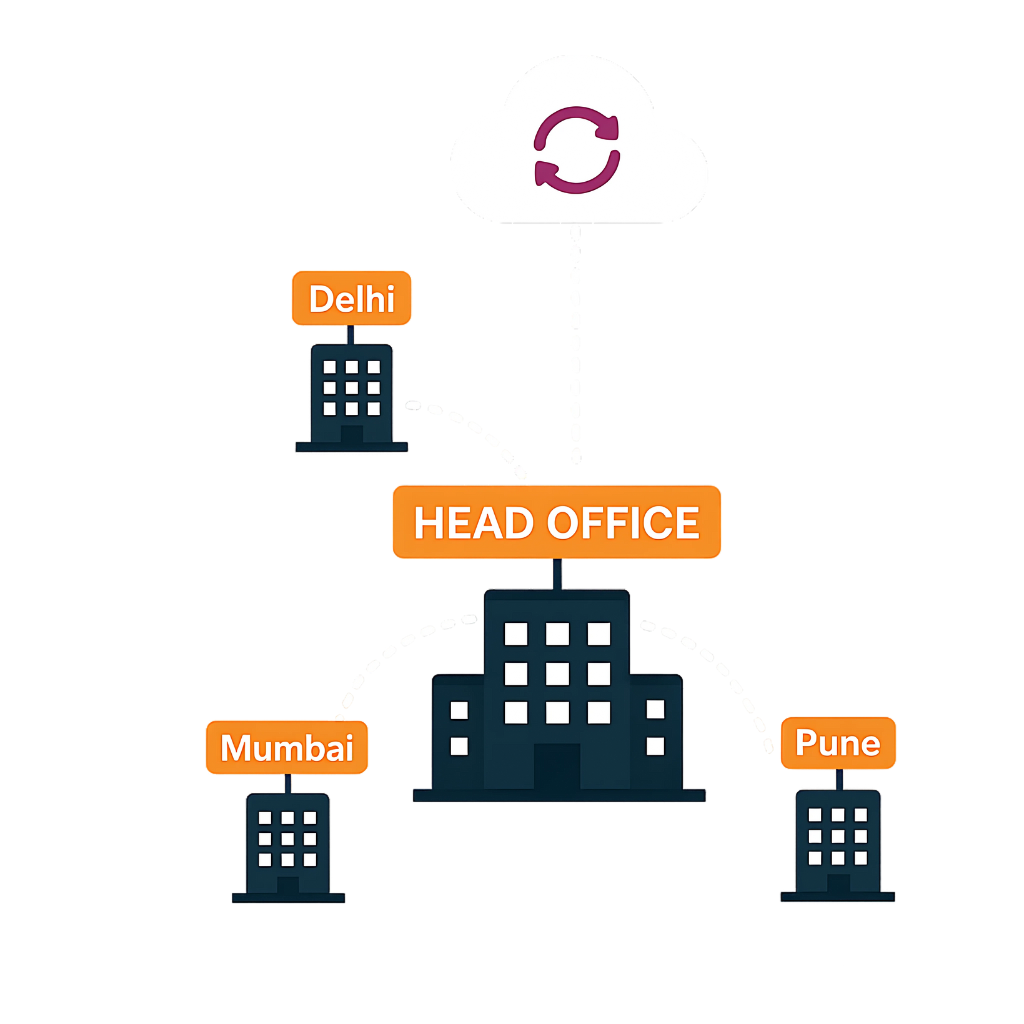

Online Data Synchronization - One Business, Multiple Locations

For businesses with multiple locations, mismatched data is a constant headache. The Pune branch shows one figure, the Mumbai branch another, and the head office something else. Without synchronization, reports are unreliable.

TSS solves this beautifully. Every branch’s Tally stays updated in real time with the head office. No more importing/exporting data files, no more “Send me yesterday’s backup.” Everything is live, accurate, and consolidated.

For a chain of retail stores or distributors, this alone makes TSS worth every rupee.

-

Banking and Payments - Faster, Cleaner, Safer

Bank reconciliation is one of the most frustrating tasks for accountants. Matching Tally entries with bank statements often takes hours. Mistakes are common, and small mismatches delay closing.With TSS, your Tally is integrated with banking services. Transactions get reconciled faster, payments are smoother, and errors drop drastically. This not only saves your accountant’s time but also improves your cash flow because you know exactly what’s cleared and what’s pending.

-

Regular Product Updates - Compliance Without Stress

India’s tax laws don’t stand still. GST rules, e-invoice formats, TDS rates - something or the other keeps changing. Without TSS, you’re stuck with outdated formats, which means wrong returns, penalties, or wasted hours manually fixing data.TSS ensures your Tally automatically gets these updates. You don’t have to download patches or worry about missing deadlines. For accountants and CFOs, this is like insurance against compliance risks.

Features You Might Be Ignoring

Here’s where many Tally users miss out. They renew TSS but don’t use its full power. Let us highlight a few underrated features:

-

Business reports from any browser: Check stock, ledgers, or outstanding balances from anywhere, even on mobile..

-

24x7 connectivity: Your business doesn’t stop when you leave the office.

-

Digital signatures: Sign invoices securely and share with clients or vendors. No dongles, no extra software.

-

Online GSTIN validation: Avoid errors by checking GST numbers directly from Tally.

-

Automated reconciliations: Matching your purchase data with GSTR-2A becomes effortless.

Each of these might seem minor, but together they save hours, prevent costly mistakes, and keep your business audit-ready.

How TSS Improves Overall Business Performance?

When we look beyond individual features, the bigger picture becomes clear:

-

Decision-making becomes faster: Owners don’t wait for emails or manual reports - they see live data and act immediately.

-

Compliance risks drop: You won’t miss GST changes or file wrong returns.

-

Operations become leaner: Instead of juggling multiple tools, everything happens within Tally.

-

Scalability is easier: Whether you add a new branch or hire remote staff, TSS keeps everyone connected.

We’ve seen small retailers grow into nationwide distributors — and TSS has silently kept their operations reliable throughout.

Who Should Never Skip TSS?

-

MSMEs under GST: Because compliance rules keep changing.

-

Businesses with multiple branches: Synchronization is non-negotiable.

-

CFOs and accountants: Who need accurate, on-demand reports.

-

Business owners on the go: Who can’t afford to be disconnected from their numbers.

TSS is Not Optional, It’s Essential

If you think of TSS as just an “update plan,” it’s time to rethink. TSS is your compliance shield, connectivity tool, and growth enabler.

Without TSS, you risk outdated processes, penalties, and inefficiency. With it, you gain speed, security, and confidence that Tally is always ready for business.

👉 Don’t wait for the next compliance deadline or reporting mismatch. Activate or Renew your Tally Software Services with Antraweb Technologies today - and experience the full power of Tally the way it was meant to be used.

Frequently Asked Questions (FAQs)

- Direct e-invoice and e-way bill generation from Tally.

- Remote access and browser-based reports on mobile, tablet, or laptop.

- Real-time data synchronization across multiple branches.

- Banking integration for faster reconciliations. Automatic product updates for GST, TDS, and compliance changes.

- Extra tools like GSTIN validation and digital signatures for invoices.

These features save time, reduce errors, and keep your business compliant.

Every Tally user benefits from TSS, but it is especially essential for:

- MSMEs under GST → frequent compliance updates make TSS critical.

- Businesses with multiple branches → real-time data synchronization ensures accuracy.

- CFOs and accountants → need accurate, on-demand reporting and faster reconciliations.

- Business owners on the go → rely on browser-based access to check reports anytime.

If you want Tally to remain compliant, connected, and future-ready, TSS renewal is not optional - it’s essential.